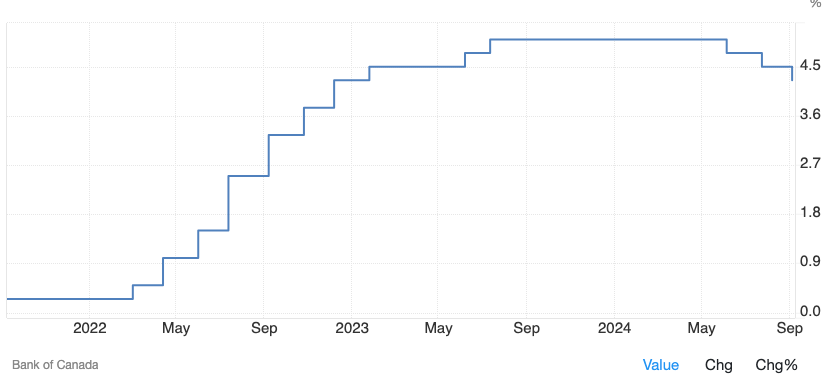

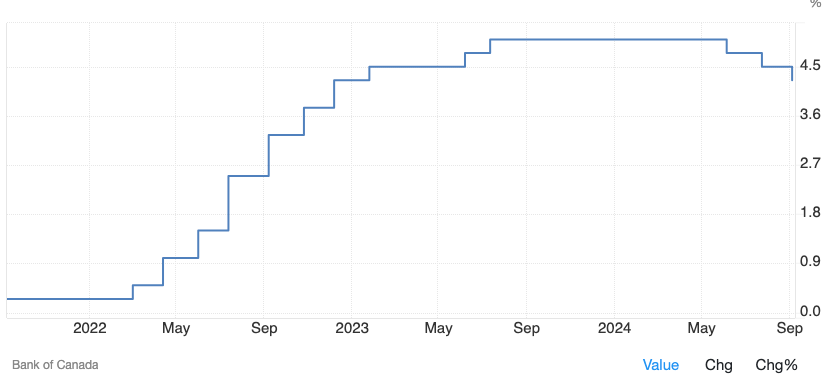

SEPT 04 2024 - Today marked the 3rd consecutive Bank of Canada interest rate cut (25pts), bringing the key rate to 4.25%. The chart below outlines the last couple years and how interest rates have risen and fallen.

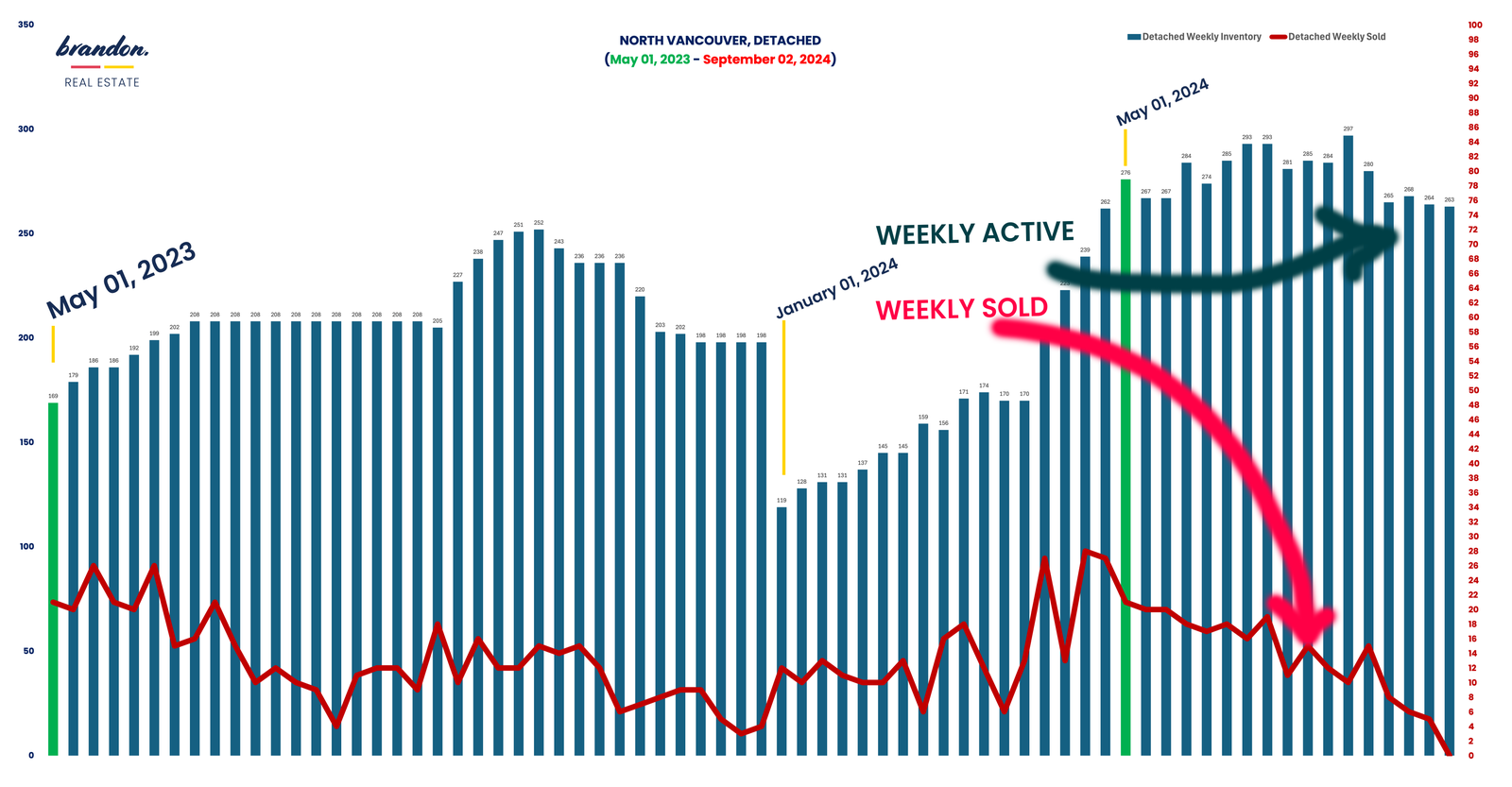

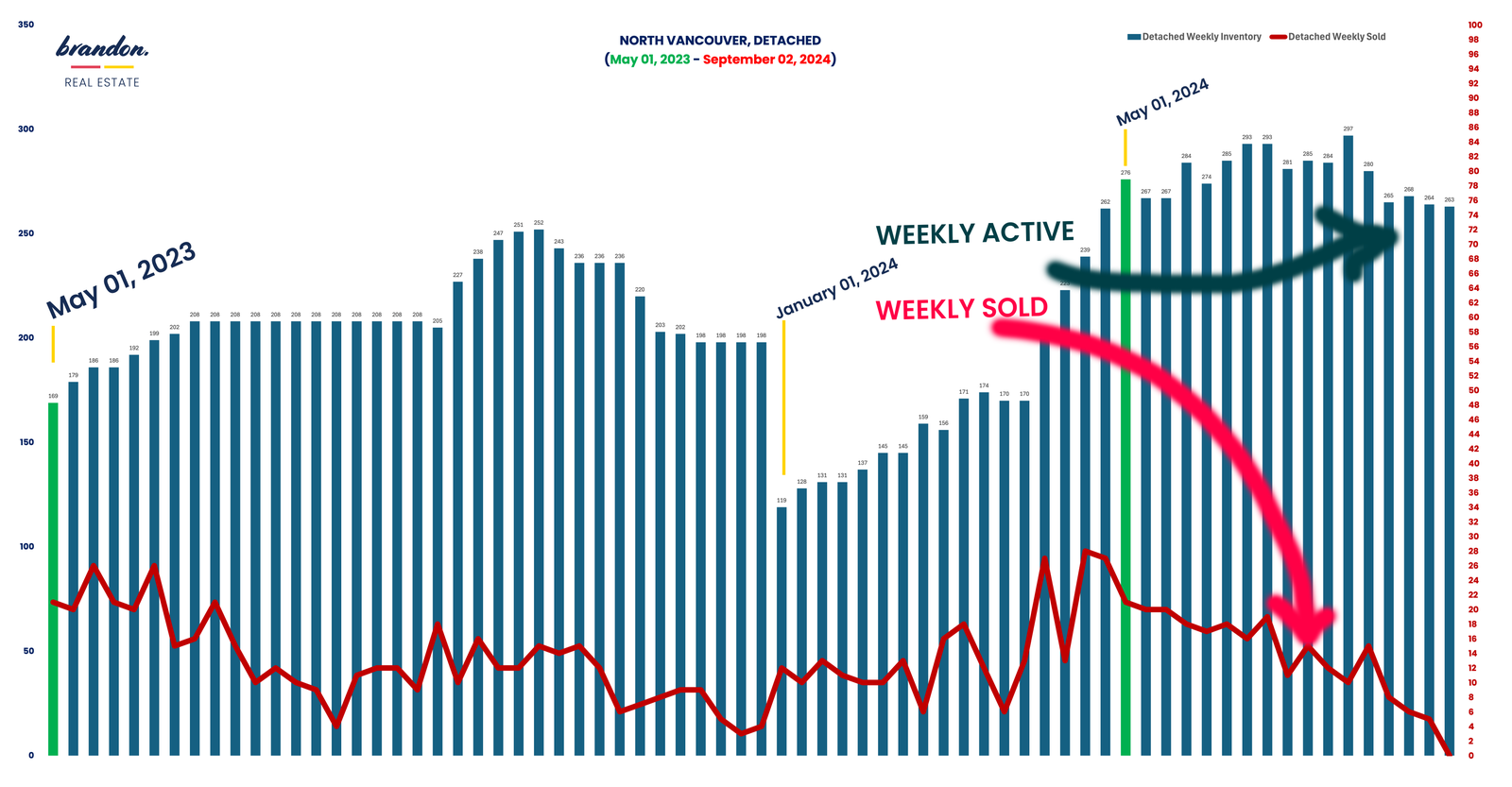

How has the North Vancouver Real Estate Market reacted to previous rates, and what does this look like moving forward? The chart below outlines May 2023 - September 2024 DETACHED HOMES (today). There is some key insights from weekly reviews here in the Detached Home Market.

How has the North Vancouver Real Estate Market reacted to previous rates, and what does this look like moving forward? The chart below outlines May 2023 - September 2024 DETACHED HOMES (today). There is some key insights from weekly reviews here in the Detached Home Market.

DETACHED - NORTH VAN

1. Weekly Solds from May 2024 onward have declined on a weekly basis. Volume of sales has slowed, which has happened at the same time that policy interest rates have declined. This could be explained by BUYERS taking a sidelines approach and waiting to see what happens with future rates. As we've seen Peak interest rates prior to May 2024 (5% key rate). This could also be in tandem with Summer months normalcy... what you would typically see in more "normal markets" as families go away, and the Summer hot months kick-in.

2. Inventory of Detached Homes have steadily increased week-over-week, topping out in the 3rd week of July (297 Detached homes on market). Since then, we have seen a pull back of "Active Listings" to today, at 249 homes. This difference represents a few solds, but most have been pricing related and have come off-market with hopes of relisting in September's more robust Fall Market (Assumptions here!!!).

** To note, its expected to see a sharp decrease of sales in the last 2 weeks data points. These 2 weeks in all the data sets do not account for homes that have got an accepted offer, and have yet to be sold (possibly have 7-10 days conditions, etc). Each week, I update the previous weeks to account for any lingering sales data.

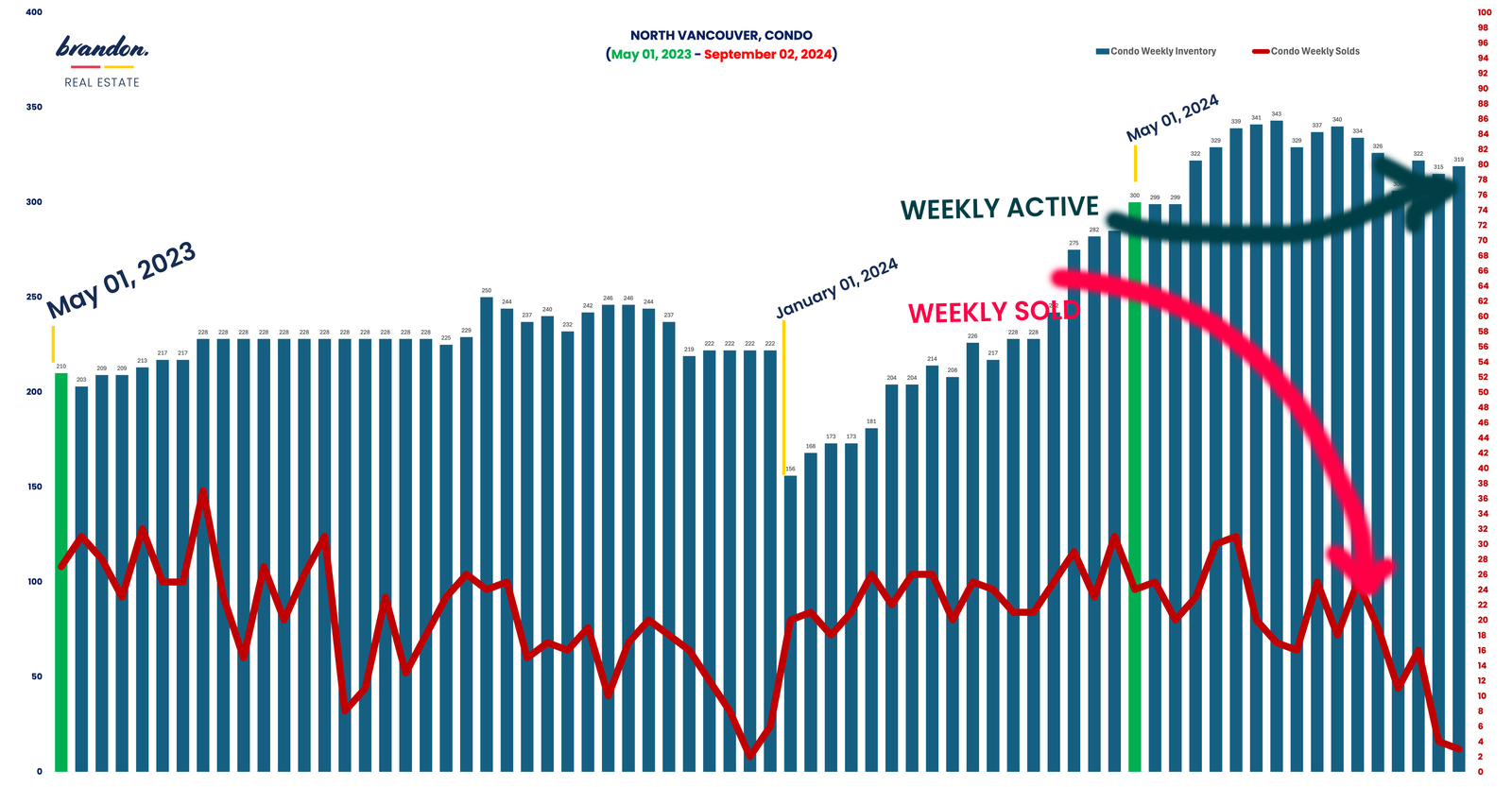

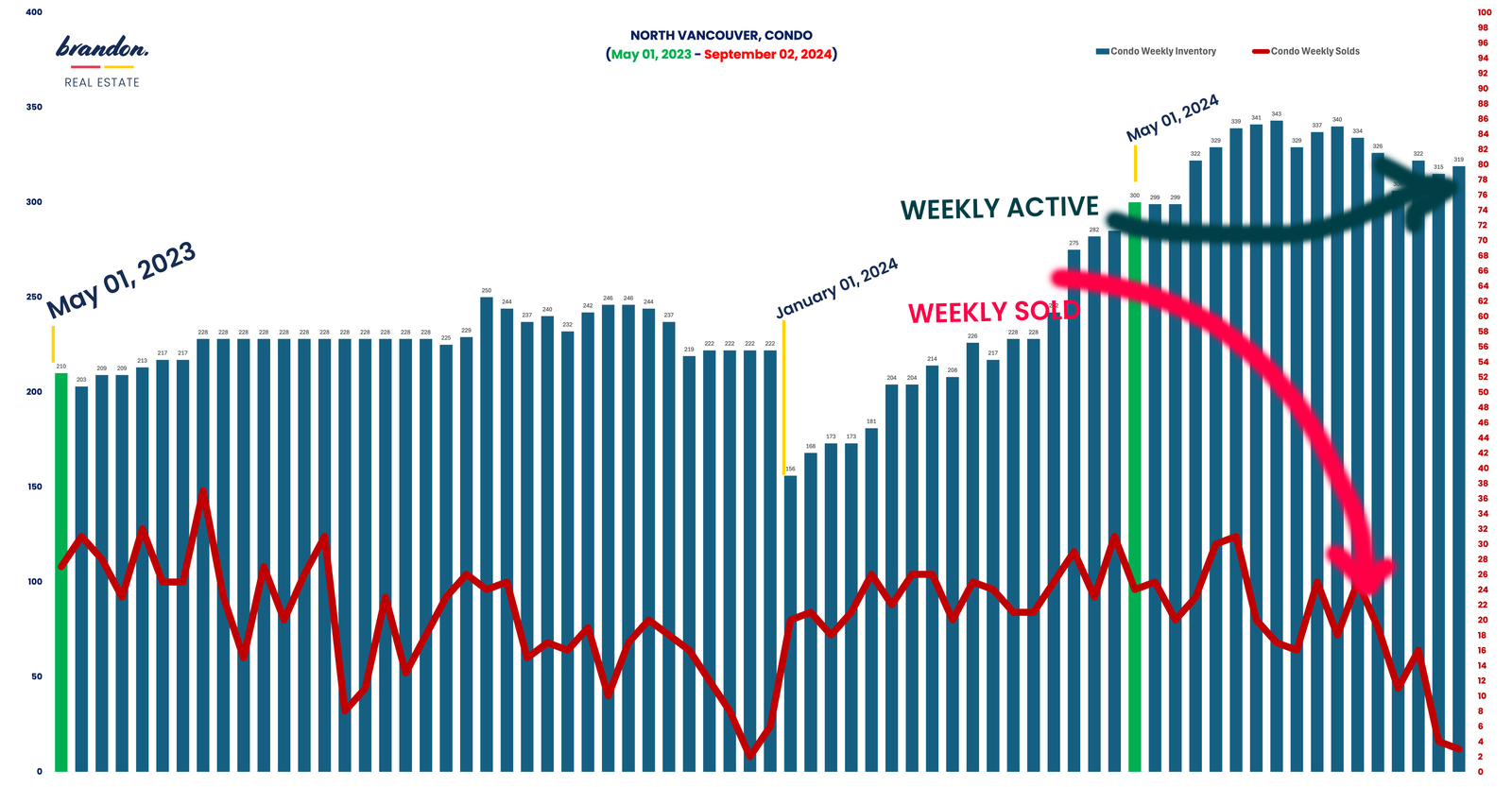

CONDO - NORTH VAN

Similar patterns exist for the Attached Condo Market in North Vancouver. From January 2024 - today inventory has climbed at a 2x pace. In January 2024 Active Listings were at 156 suites, and today that number is 319 suites.

1. Typical winter inventory sees less listings, as sellers remove old listings and get ready for the Spring Market.

2. Sales however have been steady with the condo market, not as much of a pattern in decline (excluding the last 2 weeks due to calculation and available data). This sales data shows a much more stabilized market with respect to Volume Sales. However, with the pace of new listings coming to market each week, you can expect to see a lower SALES to ACTIVE ratio. This translates into more available units on the market, without an increase in sales = buyers market for product. Buyers have more to choose from, and therefore days on market tend to linger longer.

I've noticed that competition in the higher price point $1M+ Market for condos has been a bit more saturated with listings. 33% of the inventory right now on the market is +$1M